Payments can be a complex affair for small business owners. You have limited time and resources and many things to take care of. Yet you would want your customers to be able to pay for their purchase without hassle. After all, you cannot afford to lose customers for lack of a payment choice. We understand. And we are here to help. Did you know you can accept online payments without a website? There are several ways you can do so. If you want to collect payments easily, but don’t want to bother with coding or building a website, then read on.

Top 3 Ways to Accept Payments without a Website

Payment Links

A payment link (also called pay-by-link) is a URL or QR code that you can send to your customer over email, SMS, or WhatsApp. It is a quick way to accept payments without having a website or web shop. When the customer clicks the link (or scans the code), they are led to a secure checkout page hosted by a payment service provider, like Novalnet. Once they are on the page, they can pay using cards, digital wallets, or bank transfers. The hosted payment page is customizable to your brand. You can prefill the order details, and change or edit payment methods as required. This enables one-click checkout and payment. Payment links only take a few seconds to create. If a customer wishes to cancel or modify an order, you can easily create another link and email or text it to them. When you accept payments using this method, you do not handle sensitive data directly, thus you don’t have to get a PCI DSS certification. This method is perfect if you are a business that accepts orders over email or phone.

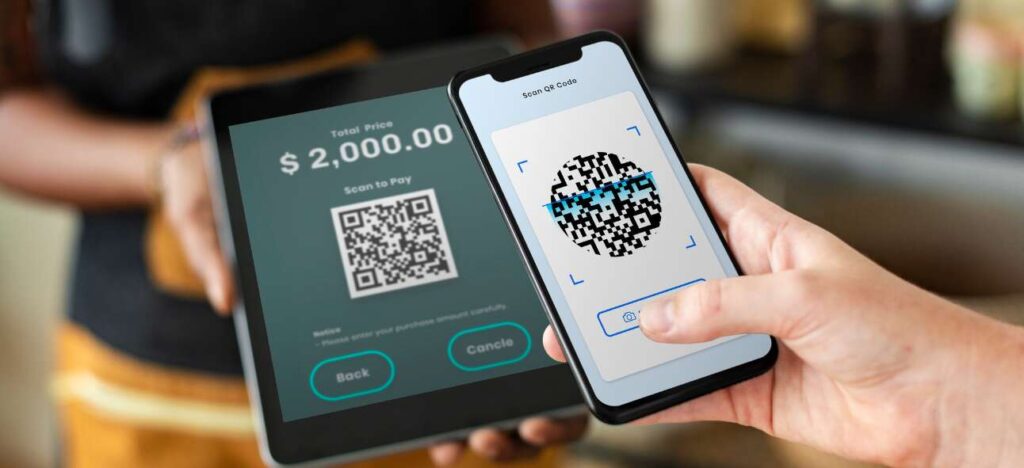

QR Codes

QR codes (also called Quick Response codes) are a swift, secure, and easy way to accept payments without a website. They are 2D matrix barcodes that can be scanned using a smartphone camera or a QR code scanner.

You can accept payments using QR codes at checkout in two ways:

- The customer scans your business QR code to pay. The code appears at your store checkout, on your products, or your invoice.

- You scan the QR code that the customer provides (for example, from their banking or e-wallet app).

These payments are encrypted, hence secure. In Europe, QR code payments are possible using PayPal. Local payment methods like iDEAL in the Netherlands and Bancontact in Belgium also allow QR code payments through their apps.

Mobile Apps / SDKs

Mobile apps are a great way to accept payments easily without a website. They provide seamless checkout and localized payment options to your customers. Mobile software development kits (SDKs) help you integrate a payment method into your business’s mobile app easily and within seconds. Mobile SDKs provide all the features that you would get from a website-based payment form, including multiple payment methods, secure checkout, recurring billing, etc. Mobile apps/ SDKs also allow you to accept contactless payments using Tap to Pay (or Tap on Phone). Merchants can use their Android or iOS device as an in-store POS terminal by downloading a third-party mobile app. These payments are encrypted and hence, highly secure.

How can Novalnet Help?

As a global payment service provider, we help Europe’s leading brands to process payments smoothly. Our technology helps you to accept payments globally in 125+ currencies in 150+ automated country-specific payment methods. Set up your payments within minutes with minimal coding using our instant payment plug-ins. Or use our AI-based risk management solutions and advanced analytics to design the best payment experiences for your customers, all in a fully secure environment.

Reach out to us today to know more about how we can help you in your payments journey.

Jose Augustine is the Chief Business Development Officer at Novalnet with extensive experience in European payment industry and a knowledge powerhouse.