Author: Gowri Shankar Balasubramaniam

From sophisticated cyberattacks to payment fraud, organizations must adapt quickly to protect sensitive data, maintain regulatory compliance, and safeguard customer trust. As cyber threats evolve, it’s crucial for businesses to stay proactive and implement robust security strategies

As digital transactions continue to power global commerce, safeguarding payment data has never been more critical. The Payment Card Industry Data Security Standard (PCI DSS) was established to set strict security guidelines for businesses that process, store, or transmit credit card information. Beyond being a regulatory obligation, PCI DSS compliance is essential for protecting sensitive […]

Real-time payment monitoring is redefining how businesses manage their cash flow, security, and customer interactions. For companies handling complex payment ecosystems, staying on top of each transaction is essential—not just for compliance or fraud prevention, but for making swift, confident business decisions. With an up-to-the-minute view of payments, your finance team can see precisely when […]

Online fraud has become a pervasive threat, jeopardizing the trust and confidence of consumers. As e-commerce businesses strive to protect their customers and mitigate risks, American Express SafeKey 2.3 emerges as a powerful solution. Failure to upgrade to SafeKey 2.3 by September 2024 may result in service interruptions and potential financial losses.

Online transactions are the lifeblood of countless businesses. E-commerce platforms, subscription services, and digital marketplaces all thrive on the seamless flow of payments. However, this convenience comes with a hidden cost: the ever-present threat of fraud. Fraudulent transactions not only eat into your profits, but also damage customer trust and reputation. The good news? Artificial […]

While advanced technology and sophisticated algorithms play a vital role in detecting and preventing fraudulent transactions, it’s crucial not to underestimate the power of the human element.

Payment threats continue to rise across Europe, exposing businesses to higher risks. Small businesses can be particularly hit hard owing to lower risk preparation. Fortunately, modern technology and payment tools can help detect and prevent fraud more effectively than before. Learn more in this blog.

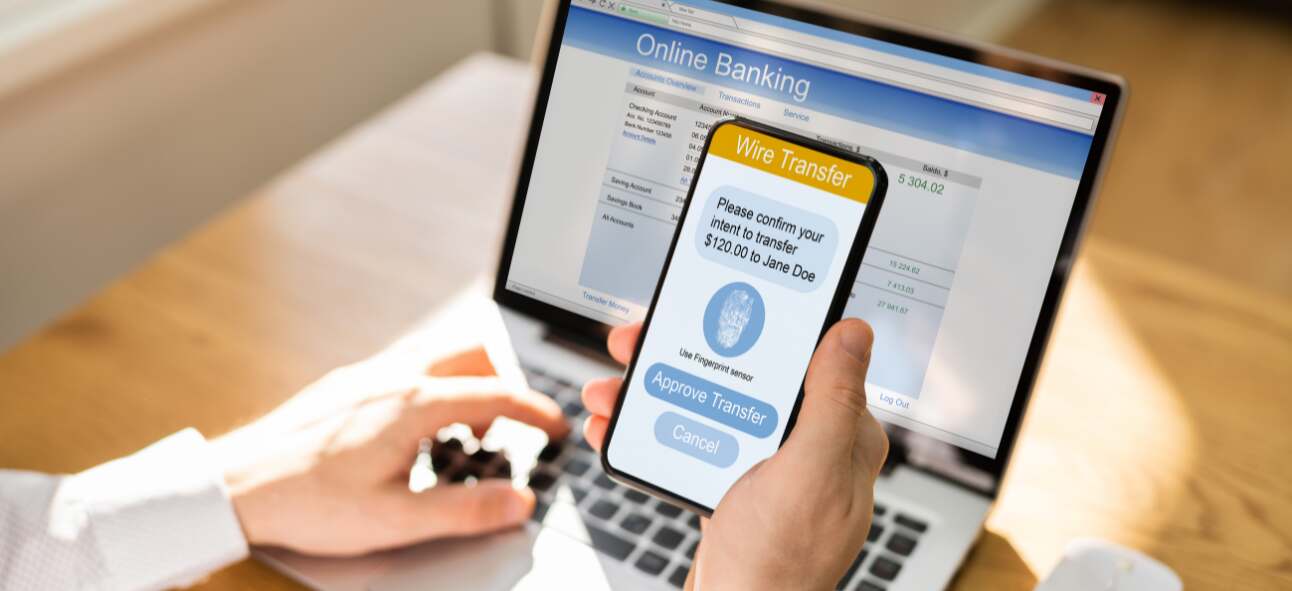

Strong Customer Authentication or SCA is a European regulatory requirement under the EU Revised Directive on Payment Services (PSD2). Strong Customer Authentication (SCA) reduces payment fraud and is mandatory in the EU. A seamless authentication process secures payments, simplifies the UX, and can greatly improve conversions. Find out how it happens, in this article

Soaring e-commerce sales in Europe also means a rise in fraud. The explosive growth of digital payments and cryptocurrencies, along with the rise of omnichannel shopping and social commerce, has made businesses and consumers more vulnerable to fraud. Fraud prevention tools can help you fight fraud effectively. But what are they and how do they work?

Safer payments are essential to your business. Payment gateway comes with efficient risk management solutions that can prevent fraud, and keep your customers and business safe. Hence, you must use the right tools and payment gateway to secure your payments from fraud and illegal activity. This blog tells you how.

Businesses are getting savvier with fraud prevention and the arrival of PSD2, open banking, and technology has greatly secured online payments. Yet, payment fraud like fraudulent invoicing continues to be a matter of concern still. Invoice scams hurt your cash flow as well as your relationship with suppliers. Know more about how to prevent B2B invoice fraud.

Are you a high-risk merchant? Do you sell globally and worry about transaction risks and fraud? In that case, you need a high-risk merchant account. In this blog, we help you understand what a high-risk merchant account is and if your business needs one. Read on to know more.