Online fraud has become a pervasive threat, jeopardizing the trust and confidence of consumers. As e-commerce businesses strive to protect their customers and mitigate risks, American Express SafeKey 2.3 emerges as a powerful solution. Failure to upgrade to SafeKey 2.3 by September 2024 may result in service interruptions and potential financial losses.

Why Upgrade to SafeKey 2.3?

- Protect Your Customers: SafeKey 2.3 provides a higher level of security, protecting your customers’ data and reducing the risk of fraudulent transactions.

- Stay Ahead of the Curve: By adopting the latest security technologies, you can differentiate your business and build trust with your customers.

SafeKey: A Shield Against Fraud

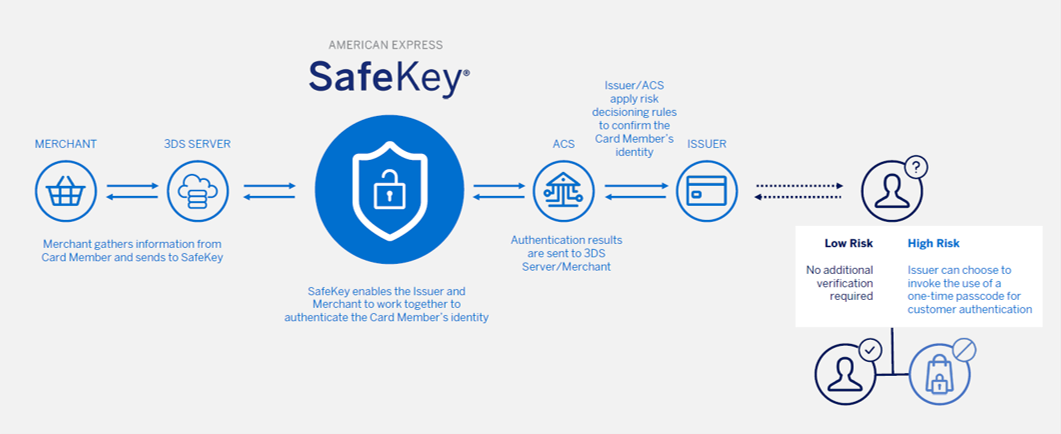

SafeKey is a cutting-edge security solution that leverages the global industry standard, EMV® 3-D Secure, to detect and reduce online fraud. By exchanging detailed information between merchants and issuers, SafeKey provides an extra layer of protection for both parties, enhancing the overall security of online transactions.

Key Benefits for Merchants

- Reduced Fraud Liability: SafeKey transfers the liability for fraud chargebacks from the merchant to the issuer, potentially saving businesses significant costs and resources.

- Increased Customer Confidence: By demonstrating a commitment to security, merchants can instill greater confidence in their customers, leading to increased sales and reduced shopping cart abandonment.

- Enhanced User Experience: SafeKey’s streamlined authentication process minimizes friction for customers, improving their overall shopping experience.

How SafeKey Works

- Transaction Initiation: When a customer attempts an online purchase using an American Express card, the merchant submits a transaction request to the American Express network.

- Authentication Challenge: American Express may prompt the customer to provide additional authentication information, such as a one-time password or biometric data.

- Transaction Authorization: If the customer successfully authenticates their identity, the transaction is authorized, and the payment is processed.

The Power of SafeKey

SafeKey offers a range of benefits for merchants, including:

- Reduced fraud: SafeKey’s advanced security measures help protect against fraudulent transactions, safeguarding your business and your customers.

- Increased sales: By building customer confidence and reducing shopping cart abandonment, SafeKey can help drive sales and revenue growth.

- Enhanced compliance: SafeKey helps merchants comply with industry regulations and best practices for fraud prevention.

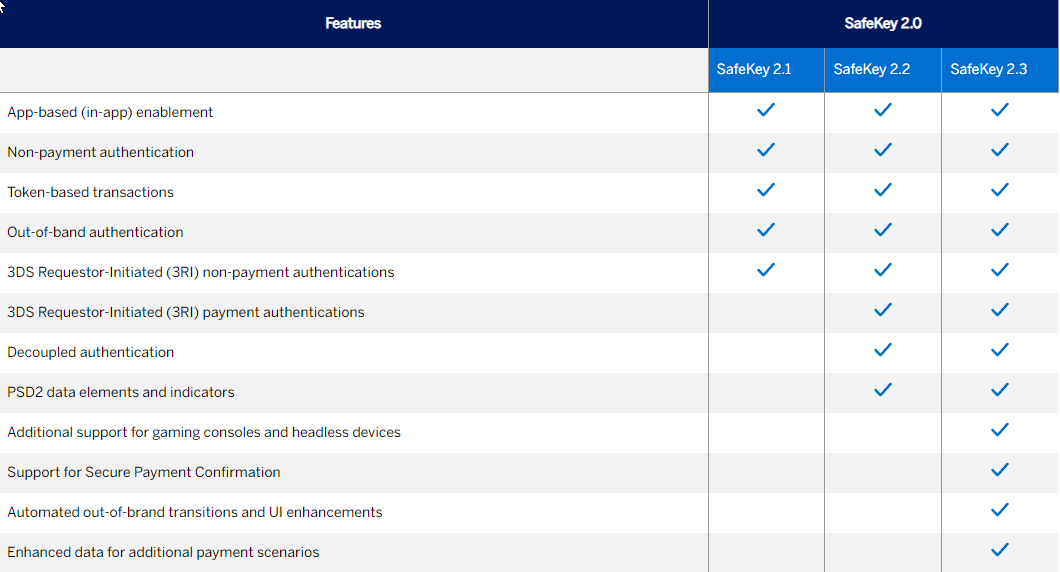

SafeKey Specifications

SafeKey specifications can be accessed through the American Express Enabled platform and Knowledge Base. Please note that SafeKey 2.1 will be decommissioned at the end of September 2024. Merchants using SafeKey 2.1 should upgrade to the latest version to ensure continued compatibility and security.

Upgrade Today

Don’t miss out on the benefits of SafeKey 2.3. Contact Novalnet today to learn more about upgrading your SafeKey implementation and ensuring a seamless transition.

Gowri Shankar is the IT Application Security Manager at Novalnet with versatile knowledge in Programming and System/Security architecture. Having 11+ years of experience in the financial services industry, Cybersecurity, Payment Card Industry Data Security Standard (PCI DSS). Certified in Advanced Payment Card Industry Security Implementer (CPISI 2.0), Secure Software Lifecycle Professional (CSSLP) from (ISC)².