Slow checkouts can be frustrating. A slow and complicated payment process is often cited as one of the top reasons for shopping cart abandonment. Click to pay has emerged as a valuable payment method in recent years, making online shopping easier and more convenient. So, what is click to pay, and how does it help your business? Find out in this blog.

Digital payments have grown in Europe, but cash is not completely out yet. Compared to a decade ago, and even more so since the pandemic, the ways people pay have changed dramatically. So how are consumers in Europe paying? Learn more in this blog.

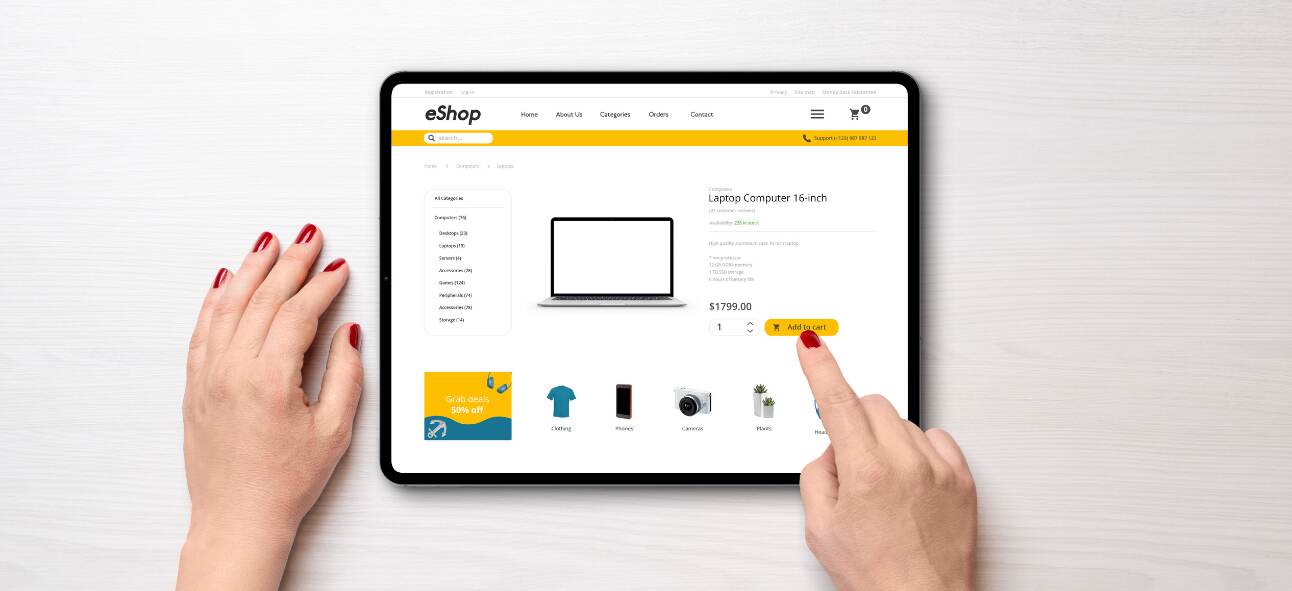

Today, e-commerce has become faster, and with it, consumer demand for speed, accuracy, and security has grown too. A smooth checkout process is vital for a successful business. In this article, find out how to create a seamless checkout experience by avoiding basic payment errors and optimizing the resources you have.

Mobile payments are essential for all businesses. Especially, with more shoppers preferring to pay with their mobile devices. Given the ease and convenience they provide, it’s no surprise that mobile payments have become people’s go-to choice for making payments, whether online or in stores. Learn what mobile payments are and how your business can accept them.

Late payments have many negative effects on a business – from hampering cash flow to creating day sales outstanding (DSO). Late payments are a big challenge for businesses of all sizes. It is one of the leading causes of the failure of many new and small and mid-sized enterprises. In this article, we tell you how to prevent and manage late payments.

Soaring e-commerce sales in Europe also means a rise in fraud. The explosive growth of digital payments and cryptocurrencies, along with the rise of omnichannel shopping and social commerce, has made businesses and consumers more vulnerable to fraud. Fraud prevention tools can help you fight fraud effectively. But what are they and how do they work?

M-commerce and mobile payments are skyrocketing across Europe. Digital wallets are favoured by merchants too, as they are more secure and are easy and cheaper to install. Merchants need to prepare to make the most of it and become more mobile-ready to reach new consumers and boost sales and brand exposure. Read on to know how

Protecting your cash flow is essential to protect your business from risks in uncertain times. Recession fears have been looming over Europe in recent times, and though latest forecasts state that the EU is set to avoid recession, economic instability still persists. In this article, we discuss a few strategies to improve cash flow, reduce risk, and keep your business resilient during a recession.

A payment service provider is essential for modern businesses. Not only do they help you process your payments, you also gain from deep insights and tech solutions that help you become more customer-centric. So, how do you choose the best one for your business? In this article, we look at 5 questions to help you choose your ideal PSP.

Subscriptions are great for businesses that sell products or services to customers on a regular basis. It is a fast and trusted way to create a consistent income while maintaining a loyal customer base. This article looks at some of the best payment methods that a business can offer for subscription services.

Why a customer-centric approach is essential in 2023 The scorching growth of e-commerce throughout Europe, and the subsequent boom in digital payments, have made the world of online retail highly competitive. Whether you are a merchant selling directly to customers, or to larger business customers, you need to cut through the clutter and create an […]

E-commerce is growing rapidly throughout Europe. The UK continues to be the largest e-commerce market in Europe. The growth of alternative payments across Europe has been huge. But how do they help your business and why do you need them? Learn more in this blog.