Category: Payments

The widespread emphasis on dynamic flexibility and interconnected solutions for a post-COVID economic resurgence is indicative of digitalization’s strong influence on global decision making, as well as, its value building abilities in the face of a global challenge. And contactless payment solutions are an important indicator of this.

Reducing payment declines is critical in creating a smoother checkout process, improving sales and creating customer delight. Visual appeal, functionality, and security are crucial touchpoints that businesses have to look at in order to boost payment acceptance.

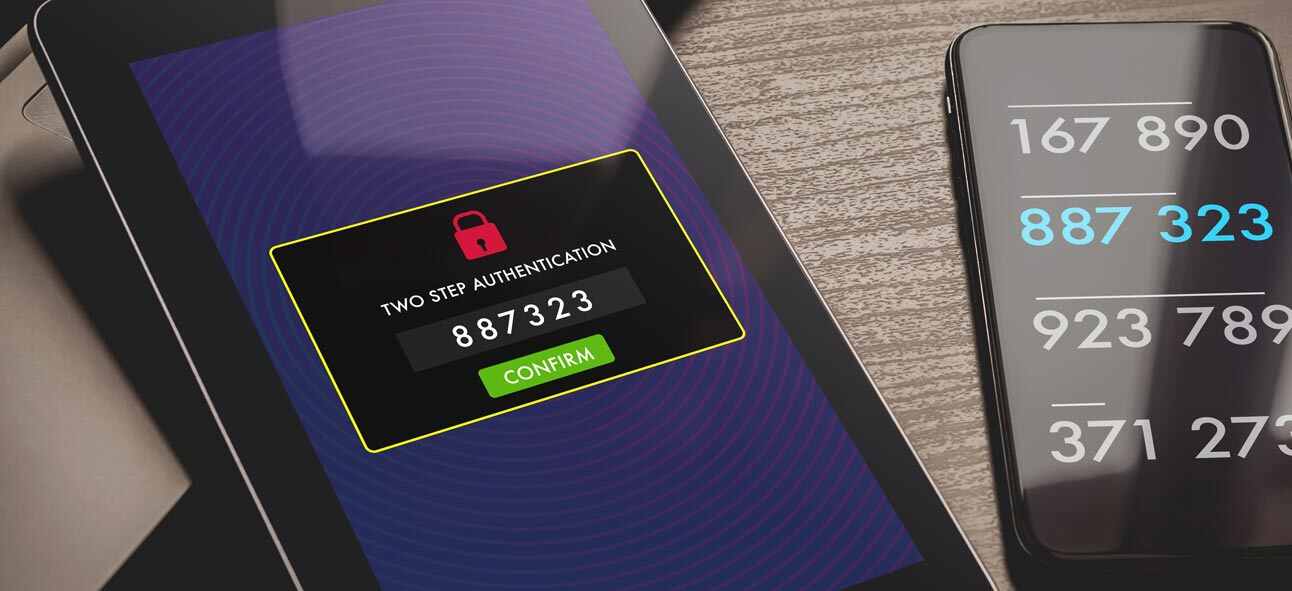

New laws to counter fraud are coming into effect in the EU. Understand how this impacts your business and your customers

Contactless, ‘one-touch’, instant payments are on the rise. And as consumers move towards alternative payments systems that offer more safety and control, the need for greater interoperability in payments systems is spurring new innovation and regulation in the industry.

In July 2020, the maximum limit for instant payment transactions will be raised from € 15,000 to € 100,000. This is expected to increase acceptance of real-time transfers and is expected to drive the development of the associated infrastructure.