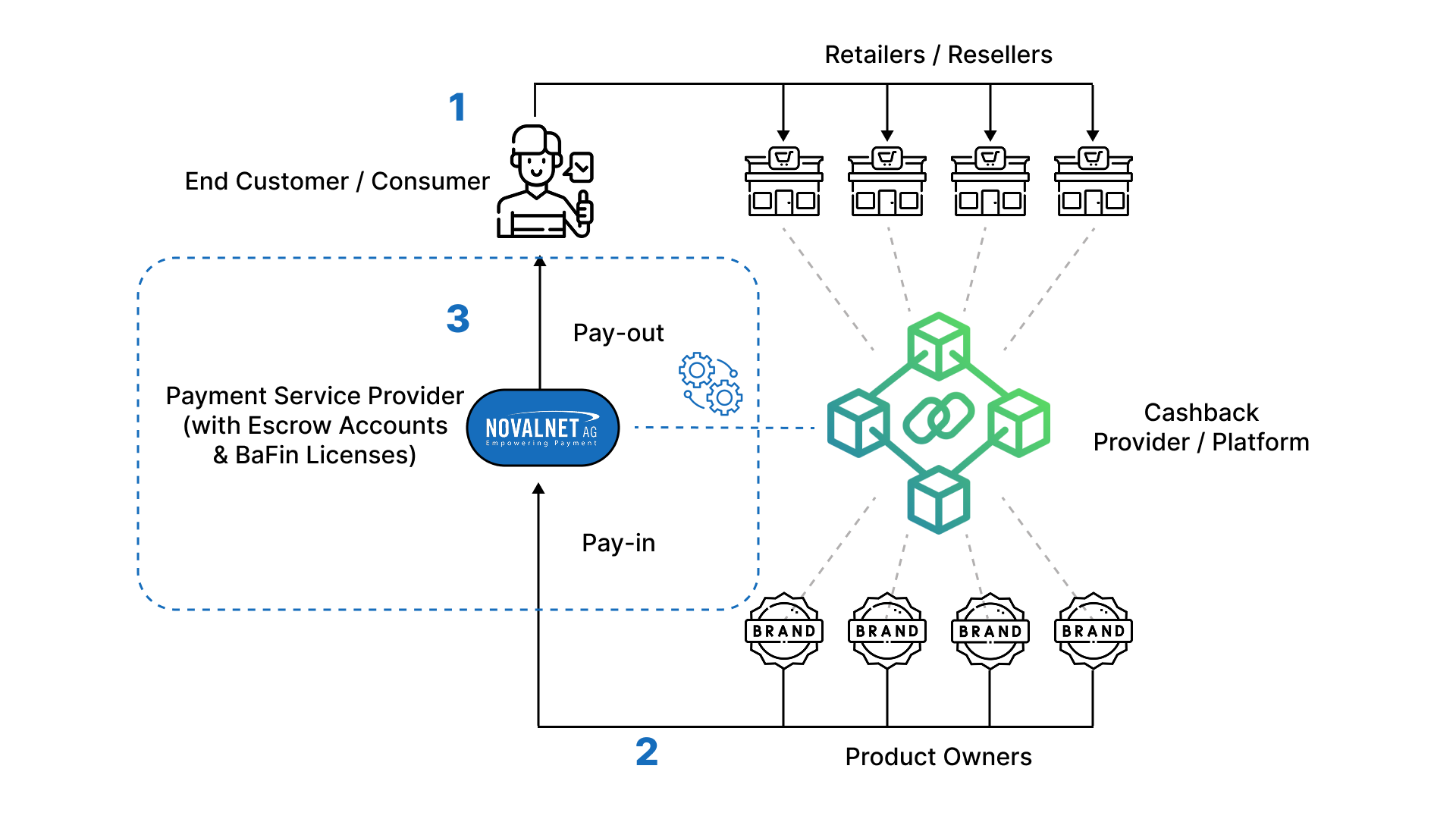

Legally compliant payments for cashback, bonus and loyalty programmes

Providers of cashback, bonus and loyalty programmes must be legally compliant in the area of payments according to the German Federal Financial Supervisory Authority (BaFin). The receipt of funds from third parties (i.e. manufacturers) into the cashback provider’s own accounts and the payment of these funds from the cashback provider to the consumer are only permitted with the corresponding BaFin licenses (ZAG § 1 Abs. 2 Nr. 6). As a BaFin-licensed payment institution, Novalnet offers legally secure and compliant processing of all financial transactions for such business models as well as insolvency-proof and seizure-proof escrow accounts.

Licensed & Compliant Payments

- Regulated Payment Institution Fully compliant with all regulatory requirements

- Secure Escrow Accounts Funds are stored in insolvency-proof and seizure-proof accounts even in the event of insolvency.

- PCI-DSS Level 1 Certified – Our security measures ensure safe and encrypted payment processing.

Operational Efficiency

- Direct integration into accounting and invoicing systems

- Individual invoice and document creation in the name and layout of the respective customer

- One-Click Payments and tokenisation for secure and easy transactions

Providers of cashback, bonus or loyalty programs should address the issue of ZAG compliance now at the latest if not already licensed by BaFin.

With Novalnet, these providers already have a reliable, easy-to-integrate and modular payment solution platform that meets all requirements of their business models. Let our experts advise you now, free of charge, on how easy it can be to achieve full compliance with ZAG.